Search

Published on:

China Year-in-Review: Technology

In 2023, the United States sharpened its focus on deterring China’s ability to develop advanced technology with the potential to threaten U.S. national security. To do so, the U.S. government has implemented several new restrictions and requirements related to critical technologies. Some of these measures, such as the announcement of an outbound investment regime, are entirely new tools. Others, like updates to semiconductor related export controls and newly sanctioned entities, build on existing regimes.

Below, we outline several of the key developments aimed at restricting China’s technology sector which U.S. and multinational businesses should remain aware of.

Executive Order on Outbound Investment & ANPRM

On August 9, 2023, the Biden Administration issued a long-expected Executive Order on Addressing United States Investments in Certain National Security Technologies and Products in Countries of Concern. In connection with this Executive Order (EO), the Treasury Department issued an Advanced Notice of Proposed Rulemaking (ANPRM). The ANPRM outlines the regulatory process and criteria under consideration for the EO. The ANPRM does not itself implement the EO but sets the groundwork for future regulatory text. Our prior blog on this subject may be found here.

The EO instructs the Department of the Treasury, in collaboration with other agencies such as the Department of Commerce, to create and execute a new national security program designed to oversee outbound investments. The newly established national security program will establish two categories of transactions involving “covered foreign persons”: notifiable and prohibited.

Notifiable and prohibited investments are certain types of investments involving “covered national security technologies and products.” These are defined to include certain technologies and products in the (1) semiconductors and microelectronics, (2) quantum information technologies, and (3) artificial intelligence (AI) sectors that are critical to China’s military, intelligence, surveillance, or cyber-enabled capabilities.

The ANPRM solicited input on the implementation of the EO from industry stakeholders. During the 45-day public comment period, a range of industries impacted by potential outbound investment regulations expressed significant interest. Common themes in the comments included (1) a need for clearer guidelines, (2) more targeted coverage to avoid adverse effects on investment and unrelated industries, and (3) broader exemptions.

Semiconductors and Microelectronics

The ANPRM contemplates a prohibition on investments in “covered foreign persons” dealing in technology, equipment, and capabilities that enable the design and production of “advanced integrated circuits” or enhance their performance; “advanced integrated circuit” design, fabrication, and packaging capabilities; and the installation or sale to third party customers of certain “supercomputers.”

The definition of “advanced integrated circuit” corresponds to the revised specifications for integrated circuits (IC) captured by export control classification number (ECCN) 3A090. Similarly, the definition of “supercomputers” corresponds to the revised specifications released in the October 2022 export control rulemaking by the Commerce Department. Under the ANPRM, investments in other companies involved in IC design, fabrication, or packaging that are not prohibited still are subject to the notice requirement.

Quantum Information and Technologies

The ANPRM contemplates a prohibition on investments in “covered foreign persons” engaged in three activities under the umbrella of quantum information and technologies. These are quantum computers and components; quantum sensors exclusively used for military, government intelligence or mass surveillance end uses; and quantum networking and quantum communications systems designed exclusively for secure communication. This category of technologies does not currently include a separate notification requirement for investments.

Artificial Intelligence Systems

Finally, the ANPRM contemplates a prohibition on investments in “covered foreign persons” engaged in the development of software that incorporates an AI system and is designed to be exclusively used for (or potentially “primarily for”): military, government intelligence, or mass-surveillance end uses. The ANPRM also contemplates a notification requirement for investments in covered foreign persons engaged in the development of software that incorporates an AI system and is designed to be used exclusively for (or potentially “primarily for”): cybersecurity applications, digital forensics tools, and penetration testing tools; the control of robotic systems; surreptitious listening devices that can intercept live conversations without the consent of the parties involved; non-cooperative location tracking; or facial recognition.

Export Controls on Advanced Computing and Semiconductor Manufacturing Items

On October 17, 2023, the Department of Commerce’s Bureau of Industry and Security (BIS) announced amendments to existing export controls on advanced computing and semiconductor manufacturing items. Our prior alert on the October 2022 controls may be found here and our alert on the October 2023 controls may be found here.

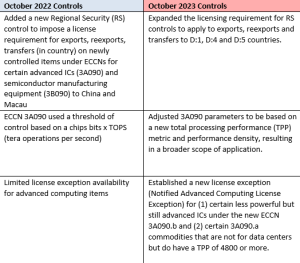

Among other changes, the October 2022 rulemaking added a new Regional Security (RS) control to impose a license requirement for exports, reexports, transfers (in country) on newly controlled items under the ECCNs for certain advanced ICs (3A090) and semiconductor manufacturing equipment (3B090) to China and Macau. The rule also added new subparagraphs to ECCNs 3A001, 4A003, 4A004, 4A005, 5A002, 5A004, 5A992, 5D002 and 5D992 to identify specific items under those classifications that are subject to the restrictions for 3A090. The October 2023 amendments expanded licensing requirements to include D:1, D:4, and D:5 countries (excluding those in Country Groups A:5 or A:6, i.e., Cyprus and Israel).

BIS has indicated that additional guidance will be published in 2024 to help industry comply with the controls.

China’s Role in Supporting the Russian Military

As the war in Ukraine continues, the U.S. government increasingly has focused its efforts on restricting Russia’s access to critical technologies. The U.S. Department of Commerce’s Bureau of Industry and Security has identified China as a country at a high risk of diversion to Russia. Moreover, the U.S. government has stated that it is analyzing materials found on Ukrainian battlefields to identify companies which are in violation of U.S. sanctions and export controls. As a result, a variety of Chinese companies have been sanctioned for supplying U.S. origin goods to Russia.

For example, on December 12, 2023, OFAC and the State Department released sweeping sanctions on over 250 individuals and entities that have been supporting and supplying Russia’s military, including many Chinese individuals and companies found to be channeling military grade goods and technology to Russia. These sanctions are an effort to close all third-party country loopholes and end Russia’s practice of evading U.S. restrictions on goods that would help further the Kremlin’s war efforts against Ukraine.

Other Posts in the China Year-in-Review Series:

Global Trade & Sanctions Law

Global Trade & Sanctions Law